- The investment will be used to promote three strategic axes, including its expansion in Europe and internationalization.

- Bit2Me is a leader in Spain with almost 50 professionals and a portfolio of more than 100,000 individual clients, companies and institutions in 105 countries.

- From its platform, it offers 20 cryptocurrency management, operation and disclosure solutions for all types of users.

- The fintech startup prepares the next investment round for 2021.

Bit2Me, the pioneering startup founded in 2014 and specialized in Blockchain financial technology and cryptocurrencies, receives the investment of one million euros from Inveready, a leading venture capital manager that has financed startups such as MásMóvil and that seeks to invest in projects with a high innovative and technological component.

After six years of hard work and progress, doubling its turnover and generating profits, Bit2Me closes its first round of financing with the international investment fund Inveready. The mission pursued by Bit2Me, a company based in the Valencian Community of Spain, is to facilitate the access and management of cryptocurrencies to anyone who wants to buy or sell bitcoin and other decentralized digital currencies. According to Leif Ferreira, CEO of the company, “Bit2Me is a complete alternative to a bank, in which cryptocurrencies (such as Bitcoin) and traditional money, such as euros coexist”.

Bit2Me has transacted more than 150 million euros from its platform, a sum which valuation today is over 2,000 million euros for its users. It currently serves more than 100 countries, with more than 100,000 registered clients on its platform and a team of almost 50 employees.

Fintech is going to focus its growth on three main lines, for which this investment will be a great boost: 1) geographic growth, promoting internationalization. 2) with the development of new products that will be added to the 20 solutions available in its Suite and continuing with the improvement of current products. “With this investment we seek to consolidate our offer in different European markets.” explains Andrei Manuel, co-founder and Director of Operations of the platform, “We are already meeting with investors to close the next round for 2021”. 3) Expanding your budgets in marketing campaigns.

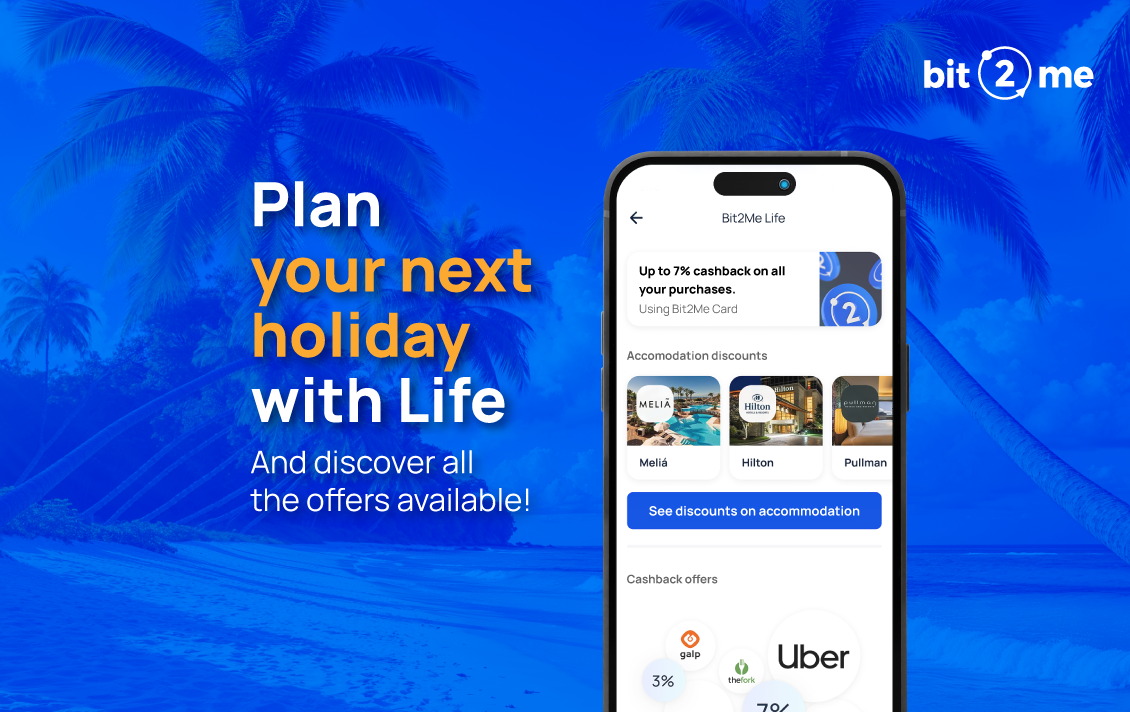

Recently Bit2Me has released a huge update of its service becoming a complete suite of 20 services used by more than a million people, offering services to individuals, companies, investors and institutions that want to or already operate with cryptocurrencies.

Bit2Me stands out for its closeness to their clients, offering phone support and guided help to those who want to get started in cryptocurrencies.

Its star product is the Wallet, a service that allows you to receive, store and send euros, but also buy, sell, exchange, send and receive cryptocurrencies such as bitcoins and 20 others. All this together with a linked VISA debit card, which will allow the use of cryptocurrencies in the same way that fiat money is used with cards by traditional banks.

The cryptocurrency sector has exhibited exponential growth with a high intensity in the last year, “The financial sector is completely redefining itself. We believe that today’s startups will dominate the financial landscape of the future” indicates Roger Piqué, General Partner by Inveready. Different studies point in this same direction, 84% of executives are actively involved in blockchain projects according to the “Global Blockchain” survey by PriceWaterhouseCoopers. For its part, the 2020 Financial Innovation Barometer prepared by Funcas and Finnovating; 42% of users would opt for a financial provider other than a traditional bank.

Decentralized digital money, which, among other things, is characterized by its issuance not being controlled by any central entity, raises the curiosity of investors and individuals as an alternative to conventional currencies and as a safe haven in the face of an uncertain panorama in traditional markets.This has happened so much, that companies such as VISA or Paypal have already integrated it into their business model and central banks in multiple countries are studying how to generate their own version of digital currencies.

About Inveready

Inveready Asset Management, based in San Sebastián, is one of the leading Private Equity managers in Spain.

Currently, it invests in recently created technology companies through 4 specialized verticals (Information Technology, Life Sciences, Venture Debt and Hybrid Financing – debt and equity – for listed companies). Inveready has 136 active companies within its portfolio and with more than € 400 million of assets under management. During the last 11 years the manager has completed successful divestments in more than 36 companies, Playgiga and MásMóvil being the most recent. Other companies in the portfolio have been acquired by multinationals such as Intel, Symantec and Red Hat (IBM), and others have been listed on public markets such as NASDAQ or MAB. Enabling the ambitions of bold entrepreneurs has become part of our DNA. Inveready is proud to have received several recognitions, highlighting the ASCRI awards for the best venture capital manager in Spain, the best venture capital operation and the best debt operation.

Author

Author