Bit2Me Card is now available for the entire Bit2Me community! You can now order the Bit2Me Mastercard that we launched on January 17 through this link and start enjoying the advantages it offers in the payment with cryptocurrencies.

Bit2Me Card is having an incredible reception from our community of users and they are getting it (in physical and virtual format) in a massive way. In this post we collect some of the most frequently asked questions that we are receiving through our social networks and the communication channels we have open.

What are the advantages of Bit2Me Card?

Using Bit2Me Card from now on has many advantages. Take note:

- Receive up to 9% cashback

- Payment in euros: directly link the euro balance to cards for payment in stores

- Card+Earn: generate rewards with the balance linked to cards

- Extra cashback program in stores: more than 200 stores (Ikea, Uber, Fnac, Nike…) where you can receive extra cashback on daily purchases.

- Receive up to 9% cashback

- No commissions or maintenance costs.

- It is an official Mastercard.

- You can pay with your cryptocurrencies.

- You can pay at more than 90 million merchants worldwide.

- You will be freer, as you won't have to work with banks if you don't want to.

- You can create a virtual card in a second.

- You can create virtual cards for online use only.

- NFC technology for contactless payments.

- Pay with peace of mind thanks to 3DS, 2FA and cold wallet security systems.

- Withdraw cash at millions of ATMs.

- Lock or disable your card whenever you want and immediately.

- Choose the cryptocurrency you want to pay with: change wallet at any time.

- Your transaction history always at hand.

- A support team available 24/7.

- Real-time notifications via email and web.

How is the 9% cashback calculated?

With Bit2Me Card you can get up to 9% cashback on your purchases. That is: we return this amount to your card once you make a purchase. As stated on our support website, this system works as follows:

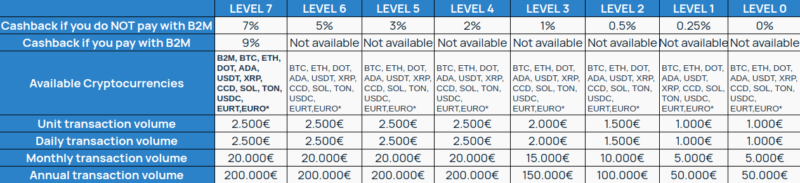

- If you do not make your purchases with B2M the percentage varies as follows:

- Level 0: 0%

- Level 1: 0,25%

- Level 2: 0,5%

- Level 3: 1%

- Level 4: 2%

- Level 5: 3%

- Level 6: 5%

- Level 7: 7%

- If you make your purchase with B2M and you are Level 1, the cashback goes up to 9%. For the rest of the Levels, as B2M is not a payment option, the option is not available.

If the message "Cashback pending" appears, it means that it is "held" by the merchant, but will be released after a few days. You will only see your cashback when the transaction is approved. At that time you will receive your reward.

What are the fees for using Bit2Me Card?

Unlike traditional banks and standard debit and credit cards, with Bit2Me Card there are no monthly or maintenance fees. Zero. There are also no ATM withdrawal fees within the European Union. How many times have you gone to withdraw money with your debit card and you have been charged 2 ¤ in handling fees? With Bit2Me Card, within the European Union, there are none. And, if you withdraw money at an ATM outside the EU, the commission is 2%, much lower than with traditional banking.

As for the transactions, only the purchase operations or the return of the purchase have an associated commission of 0.95% for the exchange of currencies (swap).

What is the cost of the Bit2Me Card?

There is no cost for any Bit2Me user to request the virtual card. All you have to do is request it through the side menu of the app > Card > by selecting the 'Virtual' tab. You can also integrate it with your NFC-enabled mobile device to make contactless payments.

Regarding the physical card, it has a manufacturing cost of €5 for Level 4 users, €10 for Level 3 users, and €20 for Levels 2, 1, and 0. Additionally, if the shipment needs to be made outside of Spain, it will have an additional cost of €5. Once it arrives, there will be no further costs: neither for activation nor for maintenance, nor for being inactive for more than 3 months, or for canceling it.

In which countries can you use Bit2Me Card?

You can use the card in any establishment, both inside and outside the SEPA territory, in more than 37 million merchants that accept Mastercard payments, whether they are online or physical merchants. However, you cannot apply for it if you are outside one of the countries of the SEPA territory. Find out here what they are.

Do I have to declare my purchases?

Yes, at least if you are in Spain. When you make a purchase with Bit2Me Card you are converting your cryptocurrencies to euros, which is what the payment is finally made to the merchant. According to the binding consultation V0975-22, dated May 4, 2022 of the Subdirectorate General of Financial Operations (in Spain), "the amount of the capital gains or losses that are revealed in the transmissions of virtual currencies in exchange for money, constitute savings income in accordance with the provisions of article 46. b) of the LIRPF and will be integrated and compensated in the savings tax base in the manner and with the limits established in article 49 of the same law". In other words: if when making that sale of crypto to make the purchase in trade you have had profits (you sell more expensive than what you bought), you will have to declare that profit. And, if you have had losses, it is also advisable to do it so that you can compensate your income tax return.

Author

Author