Cryptocurrencies and blockchain have been the biggest technological revolution in recent years and a paradigm shift that has completely changed the landscape of the financial sector.

Despite the ups and downs that cryptocurrency markets have experienced, cryptocurrencies remain a highly coveted asset, whether for their role as a hedge against inflation or for their usefulness in international payments.

The rise of cryptocurrencies in recent years has led many users to consider investing in them. However, investing in cryptocurrencies poses some challenges to the average user, such as the need for financial education and knowledge of the sector to avoid making bad decisions.

Crypto Investment Funds

Large investment firms are no strangers to these challenges and have found a business opportunity in them, creating their own cryptocurrency investment funds, allowing users to gain exposure to the assets without running the risks associated with buying them for themselves.

Investment funds that offer cryptocurrencies to their clients also mitigate the usual risks of crypto, such as extreme volatility, by creating diversified portfolios with other assets such as precious metals, variable annuities, and other assets that help mitigate risks.

These funds function similarly to traditional financial market products, only that they offer exposure to Bitcoin, Ethereum, or other digital assets.

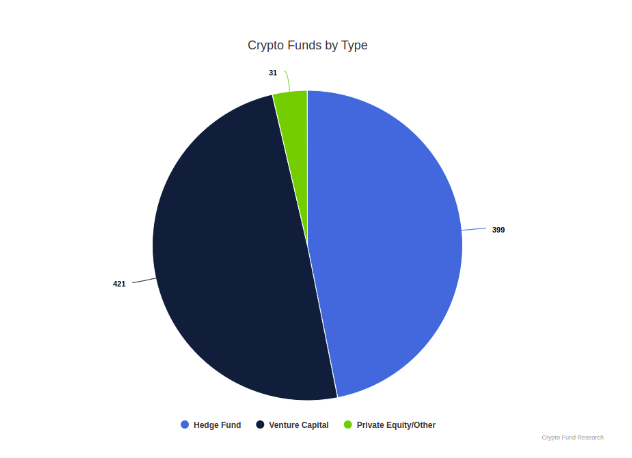

There are generally three types of cryptocurrency investment funds:

- Hedge Funds: designed to offer the highest possible return in the shortest possible time through trading.

- Venture Capital Funds: use long-term investment in promising startups.

- Private Equity Funds: invest long-term in various private companies with exposure to cryptocurrencies, such as Tesla or MicroStrategy.

How Diversification Reduces Risk

Suppose the price of Bitcoin suddenly plummets. If you only invest in BTC, you will lose all or a large part of your investment. However, with a diversified portfolio, Bitcoin money can go into other strategic assets, such as precious metals.

Holding other assets that are sufficiently uncorrelated or that even are inversely correlated can revalue part of the investment and even cushion investment losses. The risk is thus largely or even entirely hedged.

On the other hand, if Bitcoin or any other cryptocurrency the mutual fund is tied to rises rapidly, this sudden volatility will cause the fund to make a large amount of money.

Therefore, when choosing an investment fund that offers cryptocurrencies, you must always choose the one with the best balance when building a portfolio. As with investing in cryptocurrencies, it is fundamental to analyze, research, and educate yourself before choosing an investment fund.

Keep in mind that even with this initial research and even though when investing with a fund, it is the firm’s analysts who are in charge of analyzing cryptocurrencies, it is an investment and, therefore, not risk-free and may cause you to lose money.

5 Investment Funds You Should Know That Offer Crypto to Their Clients

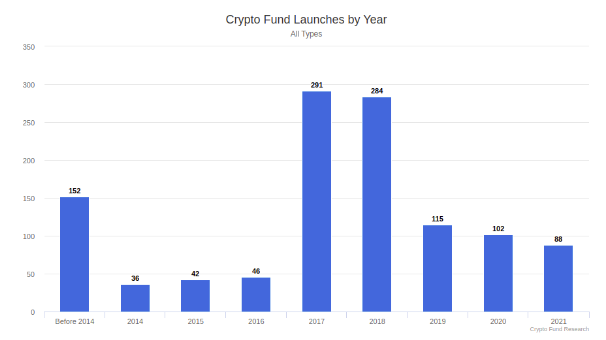

According to data from Crypto Fund Research, there are currently more than 850 cryptocurrency-based investment funds, and more than 200 have been created in the last five years.

Although investment funds offering cryptocurrencies merely account for slightly more than 1% of investment products in the market, they are one of the fastest-growing segments in the financial sector.

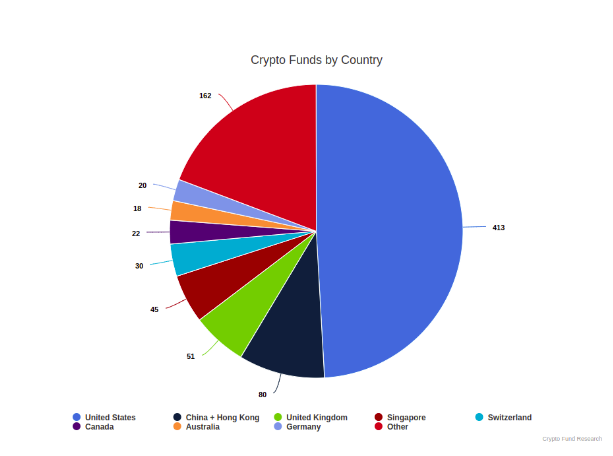

Investment funds of this type are present in more than 80 countries, although the vast majority are in the United States. They are also available in China, Canada, and some European countries, such as Germany and the United Kingdom, while in Russia and Eastern Europe, they are just beginning to appear.

Below, we have selected some investment funds offering cryptocurrencies to their users. Please note that this is not a recommendation, and we have not arranged the funds in any particular order. It is just a list created for informational purposes.

Pantera Capital

The venture capital firm founded by Dan Morehead is one of the most active in the world of crypto investments. Pantera Capital has several cryptocurrency-related investment funds, one for blockchain startups, two for investing in Initial Coin Offerings (ICOs), a Bitcoin hedge fund, and another for various cryptocurrencies.

Its investment portfolio includes such well-known names in the ecosystem as Bitstamp, Circle, Ripio, Zcash, and Brave.

Galaxy Digital Assets

This investment fund was founded by billionaire Michael Novogratz in 2017. Galaxy Digital Assets uses a hybrid business model that mixes venture capital for companies in the blockchain and crypto sector and crypto trading.

Its portfolio includes companies in the sector, such as Fireblocks, Polygon, 1inch, or Bison Trails.

Polychain Capital

Polychain is an investment firm founded by a former Coinbase employee, which manages a diversified portfolio with startups, ICOs, and cryptocurrency trading.

Polychain’s portfolio includes companies, such as Ava Labs, Acala, Celo, DFINITY, and dYdX.

BlockTower Capital

Founded in 2017 by a former Goldman Sachs employee, BlockTower Capital is a hedge fund that offers professional trading and venture capital investments and manages its clients’ portfolios.

BlockTower Capital‘s portfolio includes some of the strongest names in the crypto industry, such as Solana, Dapper Labs, Skay Mavis, and Hedera Hashgraph.

Protocol Ventures

Protocol Ventures takes a somewhat different approach to the other listed funds, as instead of investing in crypto assets or blockchain companies, it invests directly in other “highly liquid” crypto funds, including Pantera Capital, Polychain, or BlockTower.

Author

Author